he still has to figure his taxes, but now the real threat is to his social security

Stop taxing the wealthy; it'll be good for everyone, they said.

Now it's, omigod, we're out of money - we can't fulfill the promise of social security! [supposedly not funded by income taxes anyway, since that would be "socialism"]

Wealthy 78-year-old, not-yet-or-ever-to-be-retired Alan Greenspan's response to the crisis? Cut social security benefits and raise the retirement age. Just tell the masses they can keep working, even if the jobs are disappearing and nobody wants to employ older people anyway.

Not to depend too much on an ad hominum argument, but the Greenspan himself, like everyone else in this government of ours, will never need social security benefits to pay the bills. Besides, he obviously doesn't expect to retire anyway. He's far too useful to his bosses: He virtually excludes the possibility of reintroducing taxes to relieve the massive revenue shortfall.

"Tax rate increases of sufficient dimension to deal with our looming fiscal problems arguably pose significant risks to economic growth and the revenue base," Greenspan said. "The exact magnitude of such risks is very difficult to estimate, but they are of enough concern, in my judgment, to warrant aiming to close the fiscal gap primarily, if not wholly, from the outlay side."Note to file: The U.S. now has just five tax brackets, and you reach the very top rate of 35% only on income over $319,000. That percentage remains the same regardless of whether you make $320,000. or billions more. Of course no one pays these percentages in the end, but even the base figures are so modest they would be unimaginable in the rest of the modern world, which actually gets something back for its tax outlays, including real social security.

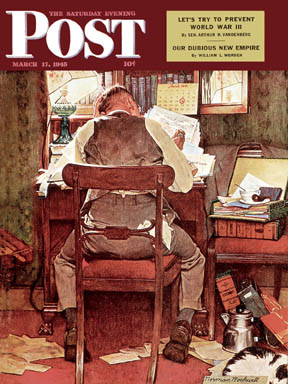

[image is Norman Rockwell's Saturday Evening Post cover from March, 1945, "Income Taxes", from Curtis Publishing; notice interesting content titles listed on the top right]